Will You Be Receiving The Child Tax Credit?

Best Hair Salons in Toms River

July 14, 2021

39th Annual Family Chicken BBQ at the Pleasant Plains Firehouse

July 14, 2021Will You Be Receiving The Child Tax Credit?

The Child Tax Credit

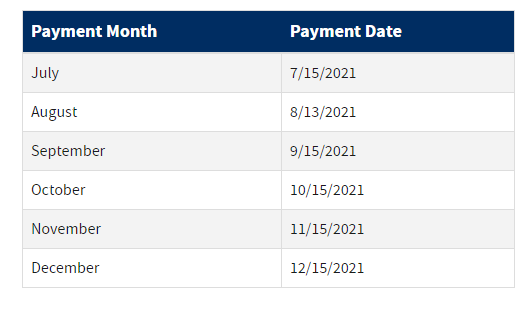

The Child Tax Credit is also known as the American Rescue Plan. It is a major tax relief for nearly all working families. Payments of $3,000 to $3,600 per child for nearly all working families. This is the breakdown if you have children.Usually you get paid once a year, now however, you will be receiving The Child Tax Credit monthly beginning on July 15, 2021 unless you opt out.

HOW DO I GET MY PAYMENTS?

Those who filed taxes and received their refunds through direct deposit will get this child tax credit via direct deposit as well. People who did not use direct deposit, checks will be mailed to them.These payments will continue until the end of the year.

See if you are eligible to receive a Child Tax Credit?